Orange Beach Police Searching For Possible Victims of Elderly Fraud

News Staff • February 2, 2025

Officials urge residents to report suspicious financial contact

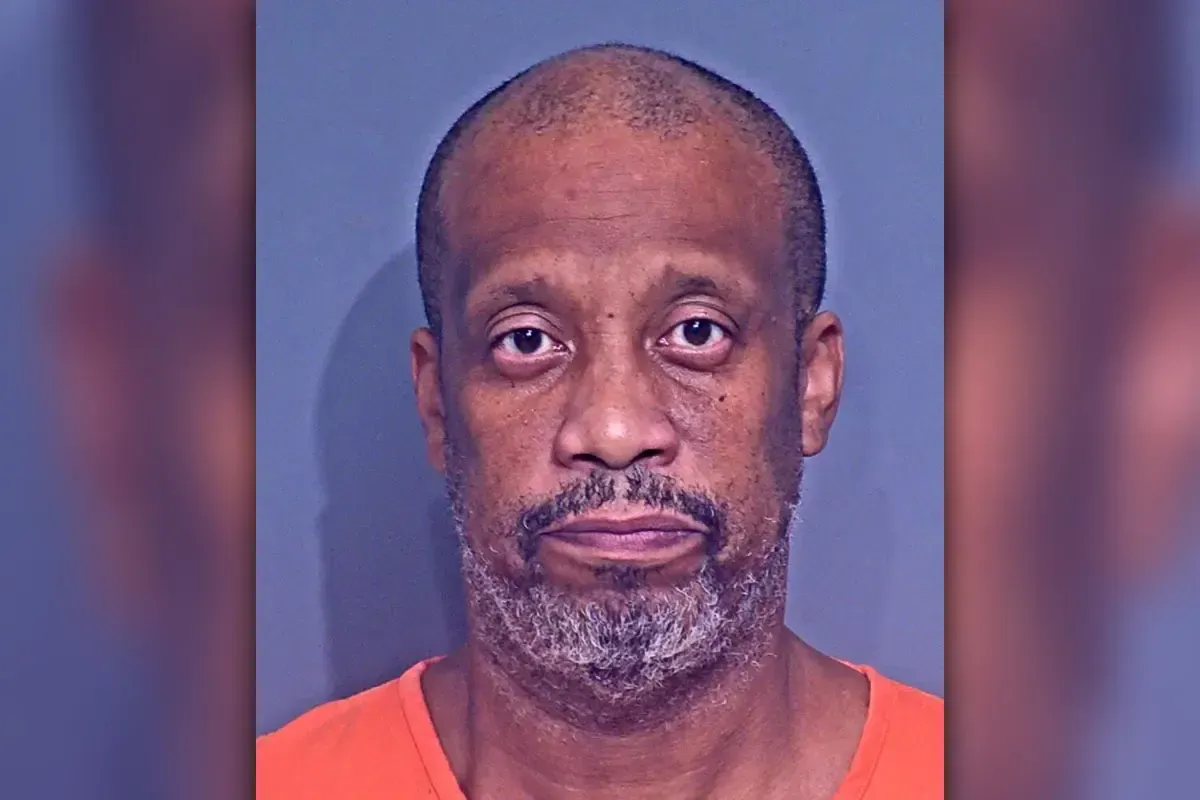

Orange Beach Police are warning the public after a man accused of financially exploiting elderly victims was released on bond. Charles Howard Nevett III was arrested in July 2024 on charges of Financial Exploitation of the Elderly. He was later released on bond in December 2024.

Since his release, officials have received reports that Nevett may be reaching out to potential victims in an attempt to commit fraud or scams. Law enforcement is urging residents to stay alert and report any suspicious contact.

Authorities are asking anyone who has been contacted by Nevett or knows someone who has to reach out to their local police department. They stress the importance of reporting any unusual financial requests or interactions to prevent further exploitation.

According to the FBI, each year, millions of elderly Americans fall victim to some type of financial fraud or confidence scheme, including romance, lottery, and sweepstakes scams—just to name a few.

Seniors are often targeted because they tend to be trusting and polite. They also usually have financial savings, own a home, and have good credit—all of which make them attractive to scammers.

Scammers targeting elder citizens may employ one or more of the following types of schemes:

- Romance scam: Criminals pose as interested romantic partners on social media or dating websites to capitalize on their elderly victims’ desire to find companions.

- Tech support scam: Criminals pose as technology support representatives and offer to fix non-existent computer issues. The scammers gain remote access to victims’ devices and sensitive information.

- Grandparent scam: A type of confidence scam where criminals pose as a relative—usually a child or grandchild—claiming to be in immediate financial need.

- Government impersonation scam: Criminals pose as government employees and threaten to arrest or prosecute victims unless they agree to provide funds or other payments.

- Sweepstakes/charity/lottery scam: Criminals claim to work for legitimate charitable organizations to gain victims’ trust. Or they claim their targets have won a foreign lottery or sweepstake, which they can collect for a “fee.”

- Home repair scam: Criminals appear in person and charge homeowners in advance for home improvement services that they never provide.

- TV/radio scam: Criminals target potential victims using illegitimate advertisements about legitimate services, such as reverse mortgages or credit repair.

- Family/caregiver scam: Relatives or acquaintances of the elderly victims take advantage of them or otherwise get their money.

Protect Yourself

- Recognize scam attempts and end all communication with the perpetrator.

- Create a shared verbal family password or phrase that only you and your loved ones know.

- Search online for the contact information (name, email, phone number, addresses) and the proposed offer. Other people have likely posted information online about individuals and businesses trying to run scams.

- Resist the pressure to act quickly. Scammers create a sense of urgency to produce fear and lure victims into immediate action.

- Call the police immediately if you feel there is a danger to yourself or a loved one.

- Be cautious of unsolicited phone calls, mailings, and door-to-door services offers.

- Never give or send any personally identifiable information, money, gold or other precious metals, jewelry, gift cards, checks, or wire information to unverified people or businesses.

- Make sure all computer anti-virus and security software and malware protections are up to date. Use reputable anti-virus software and firewalls.

- Disconnect from the internet and shut down your device if you see a pop-up message or locked screen. Pop-ups are regularly used by perpetrators to spread malicious software. Enable pop-up blockers to avoid accidentally clicking on a pop-up.

- Be careful what you download. Never open an email attachment from someone you don't know, and be wary of email attachments forwarded to you.

- Take precautions to protect your identity if a criminal gains access to your device or account. Immediately contact your financial institutions to place protections on your accounts, and monitor your accounts and personal information for suspicious activity.

Recent Posts